The Business of Beef Fundraising Lunch 2023

Heritage Bank Charitable Foundation Sub-fund

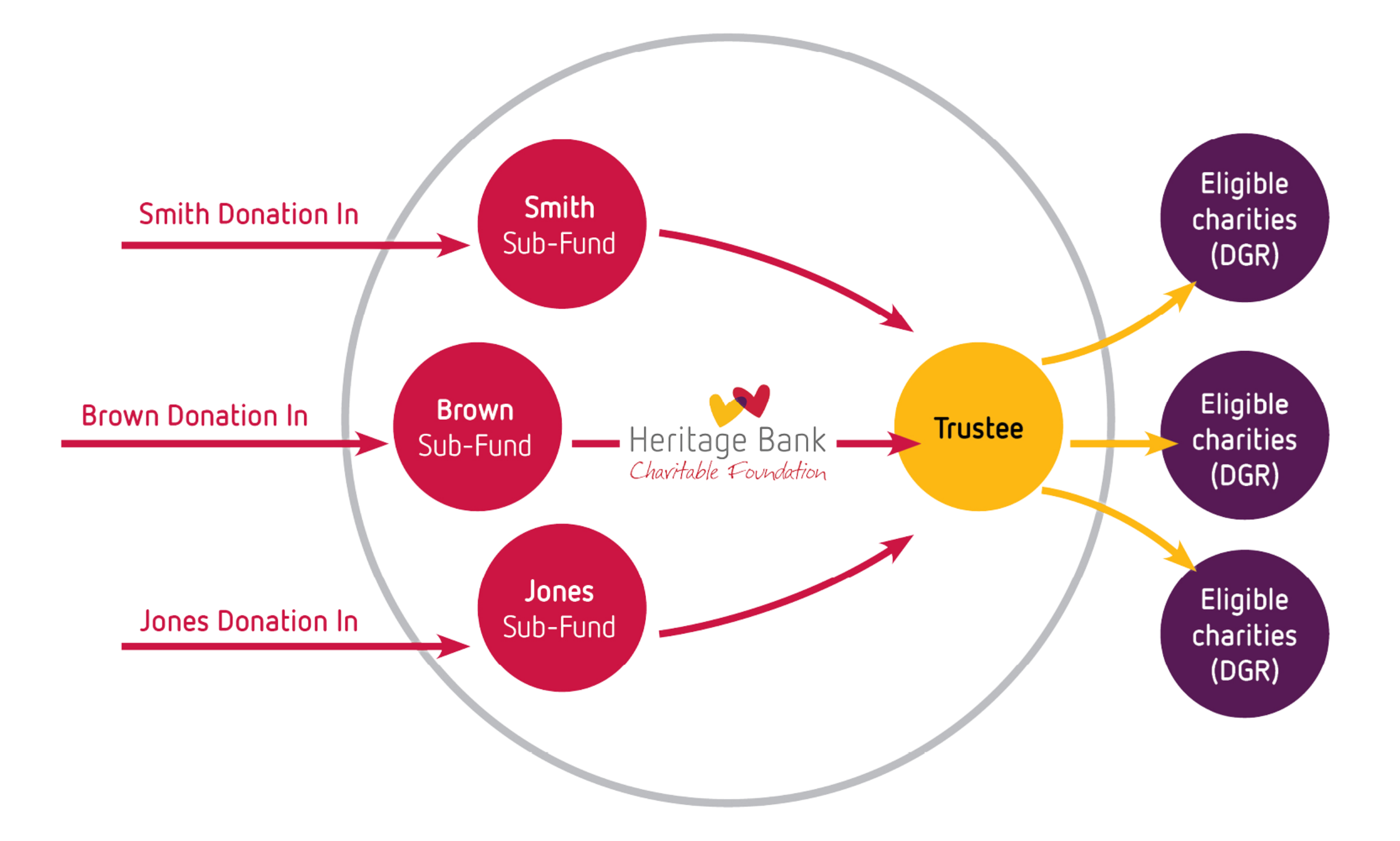

Take the next step with your charitable giving by starting your Heritage Bank Charitable Foundation “Sub-fund”. A Sub-fund could be the perfect philanthropic platform for you to make a difference, both now and well into the future. We can help you create your legacy.

A Sub-fund allows you the ability to support a wide range of initiatives. All charities supported must be Deductible Gift Recipients (DGR) and aligned with the People first focus of the Heritage Bank Charitable Foundation aimed at building and improving community wellbeing and life outcomes for people in Australia.

Example funding initiatives include:

- Education

- Health

- Cultural

- Social

- Financial Wellbeing

Your Sub-fund is your legacy. We will meet with you annually to discuss your giving recommendations. You have the ability to support multiple charities and can easily change the causes or charities you support.

Your Sub-fund can remain anonymous or be acknowledged as the key funder of your Fund’s initiatives.

Your Sub-fund is established within the Heritage Bank Charitable Foundation and is therefore governed by the same rules and regulations.

The Heritage Bank Charitable Foundation is set up as a Public Ancillary Fund. It is a philanthropic structure established by a trust deed for the purpose of making distributions to charities who are DGR under item 1 of the table in section 30-15 of the Income Tax Assessment Act 1997 (ITAA 97). The Foundation also has DGR status and can therefore accept tax deductible donations.

Each financial year, the Heritage Bank Charitable Foundation (including your Sub-fund) must distribute at least 4% of the market value of its net assets (as at the end of the previous financial year).

Your Sub-fund provides a timely tax deduction, creating a structure that allows you to focus solely on your giving without the heavy administrative responsibilities of a Private Ancillary Fund. This removes the stress of having to worry about investment, trustee and compliance duties.

Legacy

Your contribution can effectively continue in perpetuity creating an enduring legacy to remember and celebrate your involvement in making the world a better place. Further donations can be made at any time to strengthen your Sub-fund.

Impact

There are no set up or on-going fees associated with this service. Heritage Bank funds all operational costs of the Heritage Bank Charitable Foundation, ensuring all donations received, and investment income generated, is used to support our charity partners.

Structured

To maximise your impact, the Heritage Bank Charitable Foundation will work with you to develop a robust funding selection criteria. We will also complete a thorough due diligence process on all prospective recipients and annually provide a report specifically for your Sub-fund.

Flexible

You are not locked into funding the same initiative. You have the ability to change your funding recommendations annually and there is the ability to fund multiple initiatives over different funding periods.

Uncomplicated

The Heritage Bank Charitable Foundation manages all administration, investing, compliance and reporting.

Community

The Heritage Bank Charitable Foundation is intrinsically linked to Heritage Bank, Australia’s largest customer-owned bank and one of the oldest financial institutions in the country. Heritage is based in Toowoomba, with origins that go back to 1875 with the formation of the Toowoomba Permanent Building Society.

Sub-funds allow you to structure and formalise your charitable giving in a flexible environment. Please contact us to discuss how a Sub-fund could work for you. Establishing your Sub-fund is simple and starts with completing the application form. All donations are tax deductible and all earnings are exempt from tax.

Things you should know

Third round grant recipients announced

Youth Insearch weekend camp

Foundation contribution helps flood-affected communities recover

HBCF Heartbeat September 2022 Edition

Third round of $90,000 in grants for charities

Our first Community at Heart Appeal

The Business of Beef Fundraising Lunch

Weis Community Fund beneficiaries announced

The two charities who will share in $25,000 as beneficiaries of the inaugural round of Weis Community Fund grants have been announced.

The Business of Beer Fundraising Lunch

HBCF Heartbeat March 2022 Edition

$105,000 donation to support flood-impacted communities

$25,000 available for inaugural Weis Community Fund grants

The Heritage Bank Charitable Foundation invites applications from not-for-profit organisations on the Darling Downs for $25,000 in grants under the newly created Weis Community Fund.

Follow us

We acknowledge and honour the Traditional Owners of the land on which we meet, work and live. We pay our respect to Aboriginal and Torres Strait Islander cultures and to Elders past, present and emerging.